Investment Due Diligence

Supercharged Investment Due Diligence for reduced investment risk and improved business decision making.

Investment Due Diligence

All investment due diligence information at your fingertips,

without the hassle

We can help you strengthen your existing risk management frameworks to avoid any regulatory fines as well expensive lawsuits, and reputational damages. Join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Case Studies

The latest case studies for our investment due diligence solutions

Neotas were tasked to conduct management due diligence on a high profile sporting executive ahead of an impending investment deal.

Channel Capital tasked Neotas to conduct network analysis of a European company and its Director to identify related parties and entities.

Advisory firm Catalysis has tasked Neotas to conduct deep dive digital screenings for over 100 candidates in high-risk, management or senior roles.

Behavioural and non-financial risk data is now proven to enable better investment decision making.

Adding behavioural and non-financial risk categories is vital to completing proper evaluation as part of investment due diligence.

We dig deeper and faster into people, entities and networks – using additional data points has made all the difference.

Uncover the entire digital footprint of individuals and companies. Join the dots between disjointed data sources.

Our detailed network analysis can help you understand the connections, with new insights helping to pinpoint risk.

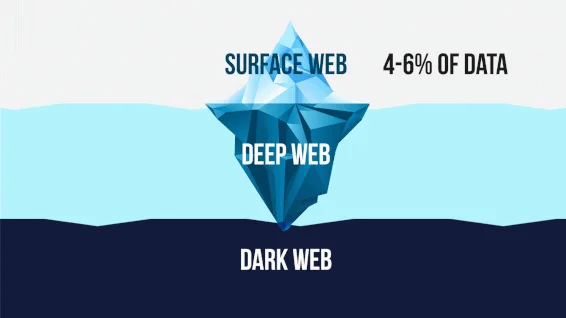

Google and other search engines only cover 4-6% of available web data – Neotas investigate 100%.

Analyse information from databases covering over 198m+ corporate records, along with over 600bn

web resources.

Don’t be limited by international jurisdictions or time sensitivities. Be able to rapidly process data in over 200 languages.

Investment risk exposure is multi-faceted and needs to be monitored consistently.

Our Ongoing Risk Monitoring helps reduce exposure, providing ‘peace of mind’ for investment managers.

We leverage Open source intelligence (OSINT) to use publicly available data to provide organizations with hyper-accurate and fully auditable insights with no false positives.

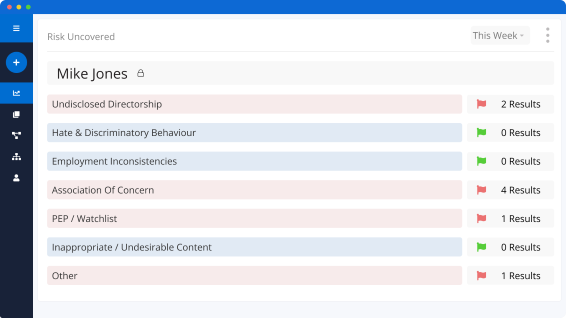

Improve Efficiencies

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

Reduce Blindspots

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Ongoing Monitoring

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Book A Demo

Frequently Asked Questions

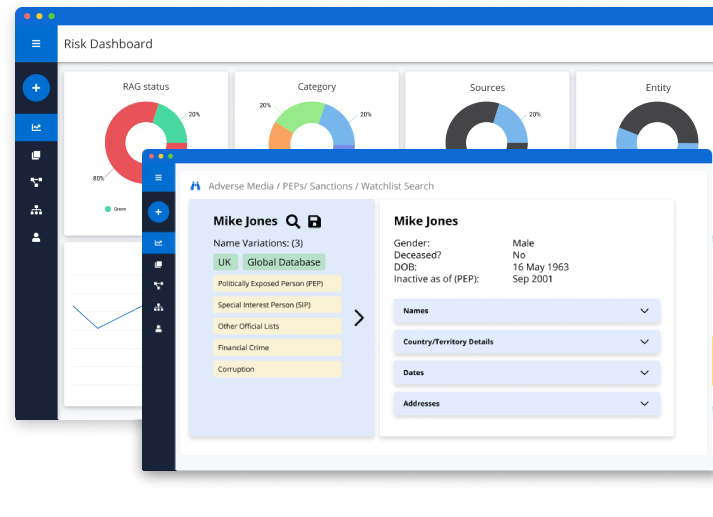

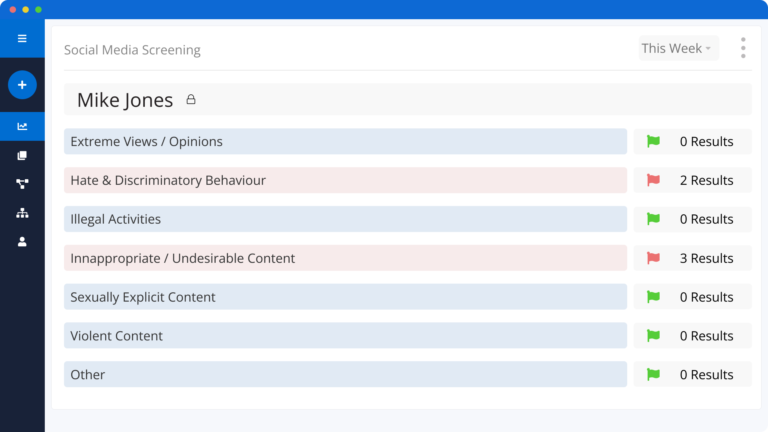

The risks we consider include:

- Financial irregularities & fraud

- Hate & discriminatory behaviour

- Violence & abusive behaviour

- Employee/client reviews

- Debarred/disqualified/insolvent entities

Links to criminal activity - Adverse media

- ESG related risks

- Modern slavery concerns

- Political exposure

- Multiple aliases

Google and other search engines only cover 4-6% of the entire internet. We apply Neotas’s proprietary investigative techniques and the science of open source intelligence to provide a richer and more complete profile of companies and individuals with greater:

Coverage: we cover traditional third party databases, the entire internet (surface, deep and dark web).

Depth: we automatically gather and analyse data using AI and machine learning, pulling information which others do not. This provides unique insights into behavioural attributes, reputation, connections (that are not in any databases).

Speed and ease of use: our easy to use Platform can conduct ‘built-in’ investigations in seconds as opposed to days and hours.

Investment due diligence refers to the process of conducting thorough research, analysis, and evaluation of an investment opportunity to assess its viability, risks, and potential returns. It is crucial because it helps investors make informed decisions, identify potential risks, understand the investment’s financial health, and align it with their investment goals.

To conduct investment due diligence for private equity funds, investors should analyze the fund’s track record, investment strategy, fund structure, fee structure, and the expertise of the fund manager. They should also assess the fund’s portfolio, financial statements, risks, and potential returns. Performing comprehensive due diligence ensures informed decision-making.

Due diligence in angel investing plays a vital role in assessing the viability and risks associated with investing in startups. It involves evaluating the startup’s business model, market potential, management team, financials, legal compliance, and growth prospects. Due diligence helps angels make informed investment decisions and mitigate potential risks.

Several factors should be considered during angel investing due diligence, including the startup’s market size and potential, competitive landscape, product or service differentiation, management team expertise, financial projections, intellectual property rights, legal and regulatory compliance, and scalability. Assessing these factors helps angels evaluate the investment’s potential and risks.

Due diligence directly influences investment decisions by providing investors with crucial information and insights about an investment opportunity. It helps them assess the viability, risks, and potential returns of the investment, identify potential red flags or concerns, and make informed decisions based on a comprehensive understanding of the investment opportunity.

Investment due diligence is the process of conducting thorough research, analysis, and evaluation of an investment opportunity to assess its viability, risks, and potential returns. It includes evaluating financials, market trends, competitive landscape, management team, legal compliance, and industry dynamics. Investment due diligence ensures informed decision-making and mitigates potential risks.

An example of investment due diligence is conducting a financial analysis of a company before acquiring it. This includes reviewing financial statements, assessing profitability, cash flow, and debt levels, and examining the company’s assets and liabilities. It also involves conducting legal, operational, and market analysis to evaluate potential risks and opportunities. Due diligence helps ensure informed investment decisions.

An investment due diligence checklist serves as a structured guide to ensure that all relevant aspects of an investment opportunity are thoroughly reviewed and analyzed. It helps investors systematically assess financial, legal, operational, and market aspects, ensuring a comprehensive and consistent due diligence process.

Key documents to review during investment due diligence include financial statements, business plans, contracts and agreements, regulatory filings, intellectual property documents, customer and supplier agreements, employment agreements, and any legal or litigation records. Reviewing these documents provides critical insights into the investment opportunity’s financial health, legal compliance, and potential risks.

To evaluate the management team during investment due diligence, investors should assess their experience, expertise, track record, leadership qualities, ability to execute the business plan, and alignment with the company’s vision. Interviews, reference checks, and background investigations can provide valuable insights into the management team’s capabilities and their potential impact on the investment’s success.

Best practices for conducting comprehensive investment due diligence include thorough research and analysis, involving multidisciplinary experts, using structured checklists, conducting site visits and interviews, verifying information and claims, evaluating risks and mitigations, performing financial and legal assessments, and maintaining objectivity throughout the process. These practices ensure a robust due diligence process and informed investment decisions.

The due diligence process for investors involves conducting comprehensive research and analysis on an investment opportunity. It includes evaluating financials, market trends, risks, and legal aspects. Investors gather information, review documents, perform site visits, and assess management. Investment due diligence ensures informed decision-making and minimizes potential risks.

Due diligence in risk refers to the process of evaluating and mitigating potential risks associated with an investment opportunity or business transaction. It involves identifying and assessing risks, analyzing risk impact and likelihood, developing risk management strategies, and implementing risk mitigation measures. Due diligence in risk helps investors make informed decisions and safeguard their investments.

investment due diligence

private equity fund investment due diligence

angel investing due diligence

due diligence in investing

due diligence in investment

due diligence investment banking

due diligence questions to ask when investing in a business

due diligence startup investment

investment banking due diligence checklist

investment due diligence checklist

investment due diligence checklist pdf

investment due diligence process

investment manager due diligence

investment manager due diligence checklist

performing due diligence on investment managers

pre investment due diligence

private equity fund investment due diligence pdf

private equity investment due diligence checklist

property investment due diligence

property investment due diligence checklist

the guide to private equity fund investment due diligence

what is due diligence in investment banking

alternative investment due diligence

alternative investment due diligence checklist

citizenship by investment due diligence

due diligence before investing in a company

due diligence checklist for investment

due diligence impact investing

due diligence questionnaire for investment managers

how to do due diligence when investing

impact investing due diligence

investment due diligence jobs

investment due diligence meaning

investment due diligence questionnaire

investment due diligence report

investment manager due diligence questionnaire

investment property due diligence checklist

legal due diligence checklist investment

operational due diligence checklist investment managers

operational due diligence investment managers

real estate investment due diligence

real estate investment due diligence checklist

startup investment due diligence checklist

website investing due diligence

what is due diligence in investing

what is investment due diligence

alternative investment due diligence jobs

alternative investment due diligence questionnaire

alternative investment management association due diligence questionnaire

alternative investments due diligence

angel investing course due diligence evaluating investment opportunities uk

angel investment network due diligence checklist

ark invest due diligence

before investing in law firm how to do due diligence

best practices in alternative investments due diligence

bilateral investment treaties due diligence

co investment due diligence

commercial due diligence ratios investment

commercial real estate investment due diligence

direct investment due diligence

distressed investment key due diligence

do commercial due diligence project prepare you for investing

due diligence and risk assessment of an alternative investment fund

due diligence angel investing

due diligence average cost investment banking

due diligence before investing

due diligence before investing in a property

due diligence checklist for alternative investments

due diligence checklist investment

due diligence cost investment banking

due diligence for investment

due diligence in investment banking

due diligence international investment law

due diligence investing

due diligence investment

due diligence investment management

due diligence investment questions

due diligence list for investment

due diligence on investment

due diligence on investment funds

due diligence on property investment

due diligence questionnaire investment manager

due diligence questions for investment managers

due diligence questions investment

due diligence reports for investments london

due diligence support investment banking

due diligence support investment management

due diligence venture capital investment

esg investment operational due diligence

family office direct investment due diligence

financial due diligence to investment banking

fsa due diligence and research of investment products

guidelines for investment due diligence

hedge fund investment due diligence report

hedge fund investment manager selection and due diligence

hotel investment due diligence

how to do due diligence on a investment bond

how to do investment due diligence

https arcanebear.com due diligence before investing

investment due diligence private equity fund investment due diligence angel investing due diligence due diligence in investing due diligence startup investment investment due diligence checklist due diligence process due diligence meaning in banking due diligence finance financial due diligence checklist how to do due diligence on a private company due diligence example due diligence in a sentence types of due diligence